BECKY'S BLOG

@rchernek

Over the last six months, the buzz around improving F&I performance has grown louder. Everyone’s talking about “getting back to basics” as the magic fix for today’s challenges. Sure, it sounds great—but is that enough to stop the ship from sinking?

Let’s be honest: since COVID, selling cars was easy. Customers flooded dealerships, and it didn’t take much to close a deal. A handshake and a smile were often all it took. But now, things have shifted. The market isn’t as forgiving, and many dealerships are struggling to adapt.

Yes, the basics matter, but there’s something deeper at play—a dangerous attitude of indifference. I’ve been in hundreds of dealerships, and what I see today is alarming. It’s like the industry is sleepwalking while the house is burning. Are dealers even paying attention? Are they willing to make the hard changes needed to turn things around?

The Desk: Where Chaos Begins

The desk is the heartbeat of the dealership—the hub where it all starts. But instead of pumping out efficient, profitable deals, it’s often the source of chaos.

Years ago, F&I managers were respected as gatekeepers. They weren’t just handling paperwork; they were protecting the dealership’s assets and managing lender relationships with precision. Fast-forward to today, and much of that responsibility has been dumped on desk managers—all in the name of “speeding up the deal.”

Here’s the catch: no one’s holding these desk managers accountable. Shotgunning deals to lenders without understanding the total cost of sale has become the norm. Sloppy credit applications, careless errors, and a lack of structure are creating a mess that F&I managers are left to clean up.

When deals hit F&I, they’re riddled with issues—missing documents, unchecked details, and no clear process. This disrupts the flow, slows the deal to a crawl, and frustrates customers. It’s a perfect recipe for lost profits and wasted time.

Broken Processes, Broken Performance

Dealers often wonder why F&I performance is lagging, but the answer is staring them in the face: broken processes. When there’s no accountability, every department operates in silos. The result? Indifference creeps into your culture, and mediocrity becomes the standard.

Ask yourself:

- Are your desk managers partners with F&I, or are they working against them?

- Are they ensuring every cash deal is turned to F&I?

- Do they know their lenders, or are they just guessing?

- Are they sticking to consistent pencils, or throwing out 84-month terms with no money down as a starting point?

If you’re not checking these things regularly, you’re leaving money on the table. A worksheet is no different from a menu—both need to be precise, consistent, and aligned with a process.

How Chernek Consulting Can Help

At Chernek Consulting , we understand these challenges and provide solutions that work. Our services are designed to address the root of the problem: your dealership’s process and culture.

We offer:

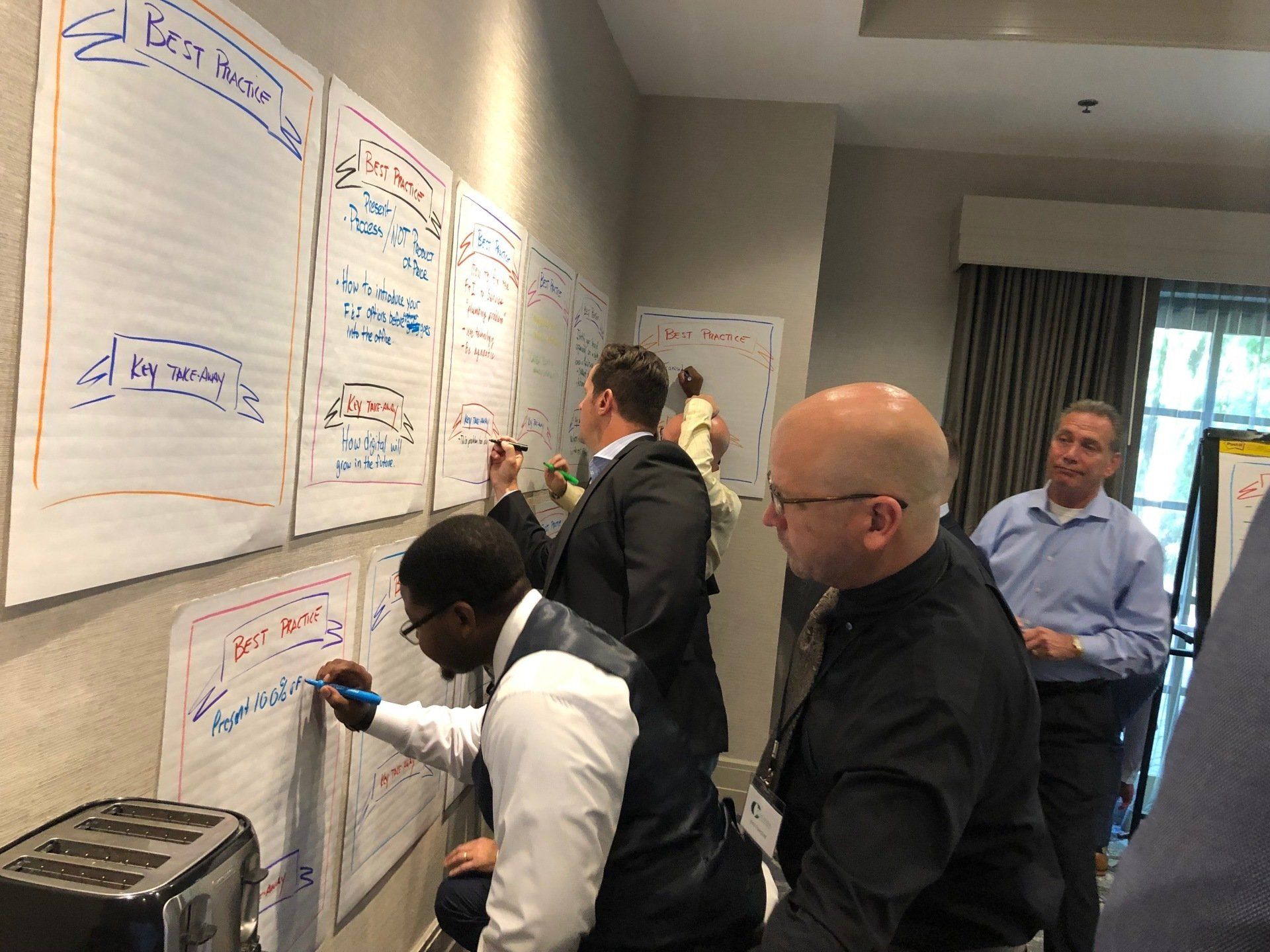

- Customized In-House Training tailored to your dealership’s unique needs.

- Virtual Training Programs to ensure ongoing education for your team.

- AI Champion Roleplay to simulate real-world scenarios and elevate team performance.

- Comprehensive Process Audits to identify inefficiencies and areas for improvement.

- Desk and F&I Alignment Programs to create a cohesive, results-driven culture.

When you work with Chernek Consulting, you’re not just improving performance—you’re transforming your dealership into a profit powerhouse.

The Cost of Complacency

Here’s the harsh reality: indifference costs you talent. Why would top performers stick around in a dealership that tolerates chaos? Talented people want to work in an environment with structure, accountability, and a commitment to excellence. If you’re not providing that, they’ll find a dealership that does.

I recently asked my F&I Today group what above-average F&I performance should look like. The consensus? It’s not just about numbers; it’s about alignment. The desk and F&I need to operate as one unit, with shared goals and mutual accountability.

Fix the Process, Fix the Culture

Dealers, if you’re serious about turning things around, it’s time to do more than “get back to basics.” You need to fix the root of the problem: your process. A strong, consistent process doesn’t just improve performance—it transforms your culture.

When everyone is on the same page—desk managers, F&I, and sales—you create a dealership that runs like a well-oiled machine. Customers feel the difference. Deals close faster. Profits grow.

At Chernek Consulting, we specialize in helping dealerships implement these changes effectively. The question isn’t whether you can change—it’s whether you will .

Visit Chernek Consulting for more information or call 866-894-1899 to schedule your consultation today. For F&I beginners be sure to sign up for Chernek Consulting Virtual Pro interactive F&I courseware upgrade to AI Champion Roleplay! Contact Becky to find out more details, available for individual users and dealer group levels. We also customize all training content to fit your exact requirements.

Recently I’ve experienced a strange déjà vu when providing onsite consultations. I’m reminded of a time when I was working with a dealer in Arkansas who purchased a Buick / GMC store. He told me there wasn’t much meat on the bone and not to expect much in F&I performance. Most customers paid cash or had prime credit.

“No problem,” I thought. After all, I can positively impact any operation. But I couldn’t help wonder why the dealer didn’t get any tier three or four business. The customers at dealerships up the street seemed to represent a full cross section of buyers. It didn’t make sense.

I continued to ask questions until the dealer came up with a brilliant idea (or he got tired of my harping). He decided to spiff the sales people one weekend $40.00 per write-up. “Just come to the desk with whatever write-up, no matter the credit, and you’ll get $40.00.” The following Monday, the dealer called to report he had plenty of tier three and four customers.

If you’re reading between the lines, you already know where I’m going. The store didn’t have any subprime lenders – or the F&I manager wasn’t keen on working subprime customers. The salespeople thought, “Why bother selling a customer a car if they said they had slow or derogatory credit history?” So they broomed the customer, sent them packing to the competitor down the street and moved to the next customer who could buy a car.

Is this you? Be honest. Because this is exactly what is happening in dealerships throughout the United States today. This is the dark side of the pandemic’s silver lining for auto retail.

The front is making big profits on preowned cars today. They don’t have to take the skinny deals or cut profit to swallow a lender fee. Those vehicles aren’t easy to come by, so they’re being saved for the customer who’s going to pay all the profit. Who can blame them?

But will it pay off in the long run? Are you sending customers to your competitor, CarMax, Carvana, Vroom or independent dealers who are lining their pockets with the deals you don’t want? The sales manager may not see the value in a lower-tier customer today, but your competition does. Because when you treat a customer with slow pay history right, you have a customer for life.

What about the customer who just paid full gross? Will they use your service department? Does it matter? That’s a discussion for another day.

You may not realize it, but many of the larger dealer groups have their own in-house financing with internal scoring metrics. They’re not only going to sell more cars; they’ll earn more profit doing it. They will take the market share if you don’t do something about it.

Some say, “Ok, let them,” but remember when CarMax offered to put an appraisal on every trade whether the customer was going to buy a car from them or not? Talk about clever! Today, customers go to CarMax to get a trade value even before they step foot in a dealership. In fact, your sales manager likely sends the customer to CarMax to get a trade value! Is that you?

Today’s most successful dealers aren’t fixed in their ways. They have a growth mindset and continually adapt to the changing market!

This bubble won’t last forever. Do you have the necessary skill-set and processes in place today to meet market conditions tomorrow?

Schedule a 15-minute Zoom call today!

Unparalleled Experience + Analytics + Gold-Standard Training = IMPACT

Chernek Consulting, founded in 2001, offers automotive dealers exceptional experience-based consultation for multipoint, multi-brand automotive groups to significantly impact performance. Rebecca Chernek has worked with industry leaders such as JM&A, AutoNation, NCM Institute, NCM 20 Groups, NADA 20 Groups, Mercedes Benz Financial Services, Sym-Tech Dealers Services and more.

Rebecca’s comprehensive analysis identifies operational and team strengths and weaknesses. Her focus is on:

1) plugging profit leaks

2) getting the customer on the right car at the get-go

3) cultivating customers for life

4) digitizing processes for maximum efficiency and profit

It’s the little things you do that can make a big difference.

CALL BECKY CHERNEK DIRECT AT 866-894-1899 schedule a 15 - minute call today!

A laundry list of products won't add more profits to the books, it will only confuse your customers!

By Rebecca Chernek

U.K. Prime Minister Harold, no stranger to recessions, said, “The only human institution that rejects progress is the cemetery.”

Those who were involved in our industry during the 1960s know that it was Pat Ryan, described by some as the father of finance and insurance as a designated dealership entity, who brought us out of the Dark Ages.

At only the age of 26, he introduced the idea that dealers should not only offer consumers financing arrangements at the time of sale, but other benefits as well, benefits such as credit, life and disability insurance and service contracts.

Within four years, his idea had grown into a $15 million business. By the end of the 1980s, Ryan had acquired or merged with other companies and, together, his newly formed Aon Corp. had 28,000 employees and was worth a few billion of dollars. By 2004, Aon employed 53,000 people, with 600 offices in more than 120 countries.

“There is only one way to do business — the right way, Ryan once said, referring to high levels of integrity and morality.

When Ryan introduced his revolutionary idea to those in our industry, it was not without detractors. In time, his proposal was accepted enthusiastically, because it offered dealers the opportunity to generate additional back-end profit through the sale of F&I products.

It also allowed them to take advantage of reinsurance profits. Most dealers benefited handsomely from this system and can do so again. But increasing profits through the sale of products must be tempered with building customer trust and loyalty through “…the highest levels of integrity in a highly principled, highly moral and highly ethical manner.”

Today, dealers have a long list of products to offer consumers: service contract, maintenance, tire and wheel, etch, key replacement, paint and fabric protection, GPS, Lo-Jack, dent-ding, diamond fusion, lease wear and tear, gap, unemployment insurance, credit life/disability, tires for life, engines for life. The list goes on.

Obviously, products are the driver to a profitable finance department. But, in today’s business climate, exactly which products bring the most value to the consumer, while creating wealth for the dealer?

What is the most effective and efficient way to present them? Why shouldn’t every value-added product available to the consumer be offered? Which products for specific dealers make the most sense?

Which products should be offered every time and with every customer, because they deliver the greatest impact to the dealer’s bottom line? The answers to these questions influence the end result. So is understanding that offering an endless litany of products in the finance department does not always lead to profits.

Now let’s talk about you and your dealership. Before you make any decisions regarding which of the wide variety of products to offer your customers, you need to put your primary goal on paper.

This gets you to think about it. And seeing it in black and white ensures you recognize the reality of your current situation. Is your goal simply to offer whichever products will bring in the most back-end profits?

Or is it to increase back-end profits while building a successful reinsurance portfolio? Or something else? Unless you commit to putting your primary goal in writing, you will not know what needs to be changed and why.

Once you know your goal, ask yourself another series of questions.

Begin with an assessment of all the products available to you. Is this the best product of its kind and at the right price?

Do I have complete trust in the product company? What are my product partner’s expectations and can I meet them? Can they meet mine? Can I fully support the product and its value for my customers? What are the negatives, if any? Will my F&I manager agree with my assessment and be enthusiastic about offering the product to my customers?

Ironically, few dealers ask their F&I managers if they believe the offered products on their menu have intrinsic value over other similar products.

Why is this necessary? Unless they can wholeheartedly support the product, they will be unsuccessful in not only presenting the product but in overcoming customer objections.

The only way to know for sure if a product should be on your menu is to make product comparisons and conduct thorough research. Especially in today’s market climate, every dime a consumer spends must have proven value.

Presenting your menu with a long list of products will seldom increase products sold. It will, however, confuse the customer and diminish their interest in buying any!

Today’s more savvy and cautious vehicle buyers are looking for the best quality, the lowest price, and the best terms on everything. Dealers must be prepared to answer their every question candidly, convincingly, and conscientiously.

F&I trainer Rebecca Chernek is CEO of Chernek Consulting, LLC. She can be reached at 866-894-1899 or email Becky at becky@chernekconsulting.com

Effective Closes Are Based On Effective Rationale

By Rebecca Chernek

No two snowflakes are exactly alike. The fingerprints of no two people are alike. The customers who step onto your lot are not exactly alike either. So why are you still treating them as though they were?

Perhaps you’re not capturing more product sales for this very reason. Effective closes are based on effective rationale, and the underlying principal of selling to all of your unique customers is to first get to know them and then sell to only their needs with an individualized presentation.

Not only has the car- and product-selling environment changed over recent years, so have your customers.

What you did years ago — and even last year — to obtain the sale no longer works as efficiently.

If you were to approach your customers sporting a 1970s-style mutton sideburns and wearing bell-bottom slacks, you wouldn’t be taken seriously.

If you were to approach your customers as though they had just won the state lottery, they would turn on their heels and run.

If you still take your customers to your office, shut the door, and force-feed them memorized hard-sell lines, such as “You need all these products and I’ll tell you why,” you’ll only succeed in losing the sale altogether.

These days, most customers come to you well prepared. They know what they want and why and how much they can afford to spend. They’ve become product savvy through hours of online investigation.

What should you do? Research the same online sites they do. See what they’re reading. Learn everything they do. Know why your products are equal or better and why buying from your store is better.

Think about how you can present this information without being a pushy know-it-all salesperson; the kind most buyers dread.

Then, greet all your customers at the sales personnel desk with friendly and unhurried interest. This is the time and place to review their information.

Verify the transaction details, without interrogating them with rapid-fire questions. Be engaging and unscripted. Establish a friendly rapport while learning about your customers’ buying habits and perceived needs.

Don’t assume anything. Encourage them to talk and then listen! Without solid information, it’s difficult to effectively overcome objections.

You are accustomed to beginning a memorized product pitch the second your buyer is seated. After a year of slow sales, you are even more eager to squeeze it all in.

Your customers, however, are counting their pennies. They’ve had a rough year, too. They must never feel that you are trying to sell them things they don’t need or want.

Present your products confidently, but with heightened decorum. It shouldn’t pain you to hear any customer say, “No, I’ll stick with the base payment.” This happens at least 50% of the time. That response should never persuade you to close the deal.

This is the time to quietly state that certain products bring beneficial value and not taking advantage of the opportunity to add them to the base price could negatively impact their circumstances in the future.

So, ask for the reason the products are being rejected. The cost? The packaging? Simply not interested? Don’t assume anything. Know your subject matter.

Never ask a question without having the answer. If your customer says he plans to put on 15,000 miles a year and keep the vehicle until the wheels fall off, it makes sense to ask why he’s not taking advantage of a service contract.

You already know his answer. It costs too much. The best way to overcome such objections is to match them with a proper response, a logical one.

Today’s customers can adapt to a higher payment, but not to surprises. Win them over through effective closes based on an easy-to-understand rationale for each product presented. They will buy, thank you and return next time.

F&I trainer Rebecca Chernek is CEO of Chernek Consulting, LLC. She can be reached at 866-894-1899 and becky@chernekconsulting.com